Does Renewable Energy Have a Higher EROI Than Fossil Fuels?

There is new momentum behind the idea that renewable energy has a higher energy return on investment (EROI) than fossil fuels.

That contrasts with decades of consensus that the EROI of oil, for example, ranges from 18 to 35 while the range for solar is from 6 to 12.

Nafeez Ahmed wrote in a recent post that

“While the EROI values of wind and solar are “at or above 10”, the average EROI estimate for oil is about 4.2. Murphy et. al’s research concludes that many EROI analyses incorrectly compare fossil fuels with renewables by measuring them at the wrong areas. By consistently measuring them both at their ‘point of use’, they are able to develop a far more consistent approach.”

Similarly, Ugo Bardi wrote a post in January whose title was ” Setting the record straight on the EROI from renewables. It is much better than that of fossil fuels.”

Both Ahmed and Bardi used a 2022 paper, Energy Return on Investment of Major Energy Carriers: Review and Harmonization as their source.

Net Energy and EROI Essentials

Net energy is the difference between the total energy output minus the total energy input over the life cycle of an energy source or technology (Figure 1).

EROI is the ratio of the total energy output divided by the total energy input over the life cycle of an energy source.

That means that the net energy for a 10 megajoule (MJ) energy input and a 20 MJ output is 10 MJ and the EROI is 2 (Figure 1).

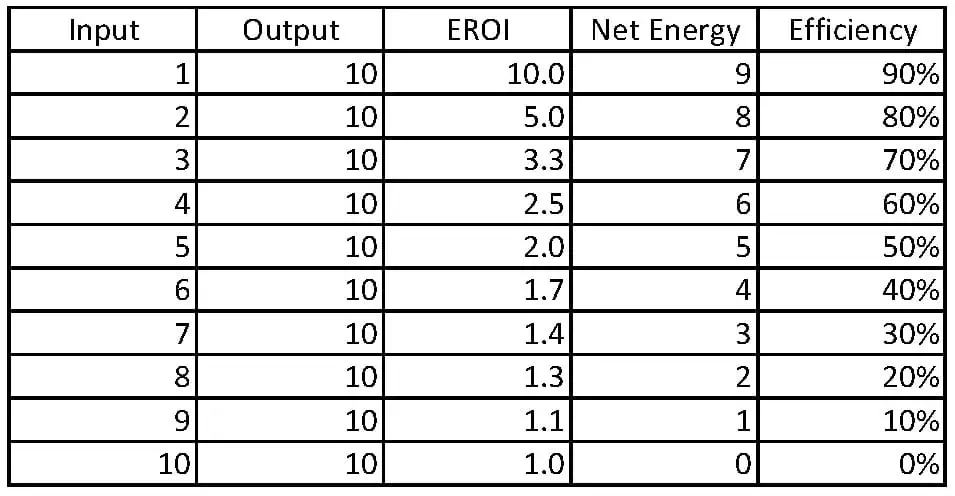

Table 1 shows a range of energy inputs and outputs and their corresponding EROI and net energy values. The important observation is that EROI is non-linear while net energy is linear.

For example, an EROI of 10 is twice as great as an EROI of 5 but only represents a 10% (90% vs 80%) difference in net energy or the efficiency of the transformation from source into usable energy.

It would take an EROI of about 1.9 to produce a net energy decrease of 50% compared to an EROI of 10. That’s why EROI adds more confusion than value at least for the casual user.

Red Flags

I evaluated the 2022 EROI paper by David J. Murphy and colleagues that Ahmed and Bardi cited as the source of their good news about the superior EROI of renewables.

This statement from that paper was a huge red flag for me.

“Even if crude oil were measured to have an EROI of 1000 or more at the point of extraction, the corresponding EROI at the point of use, using global average data for the energy “cost” of the process chain, would still only be a maximum of 8.7.”

This means that the supply-chain energy costs for refining and product distribution create a permanent penalty that prevents oil from reaching an EROI of more than 8.7. It furthermore implies that refining must be a marginally profitable business at best which it is not.

It suggests that all previous EROI work over the last two decades was wrong. The reason it was wrong, according to the paper’s authors, is that previous workers failed to account for the full supply chain of energy investments from extraction to point-of-use. That is simply untrue. The approach has been used at least since 2009 by Hall et al.

By the authors’ own admission, oil is the most important fuel for the global economy. An oil EROI of 4.2, however, would place it below what most researchers consider to be the minimum EROI threshold needed to support society as noted by Euan Mearns.

“It is assumed that ERoEI >5 to 7 is required for modern society to function. This marks the edge of The Net Energy Cliff.”

In this renewable energy Hail Mary, the authors reveal their fundamental failure to comprehend the significance of their EROI subject:

“This means that oil delivers less net energy to society for each unit invested in extraction, refining, and delivery than PV or wind. The transition to electric vehicles, according to these results, will actually increase.”

Society does not function and survive on the per-unit net energy to society but on the full-system net energy delivered to society. This is like saying that I can solve my personal financial problems by delivering newspapers because the per-unit returns are so high. The net income from the paper route is so small, however, that it wouldn’t even help with the monthly escrow payment on my mortgage.

The bottom line is that Murphy et al have not presented the data to support their conclusion that renewables in fact have a higher EROI than oil.

Lack of Transparency

The biggest problem with net energy and EROI research is that it is almost impossible to accurately identify all or even most of the energy inputs. This is compounded by different workers using diverse and sometimes incompatible methods to determine the values needed.

The stated purpose of David Murphy and colleagues’ paper was to clarify the confusion. This is an admirable and much-needed effort. They did not, however, provide the necessary data to support their findings.

There is no a table or graph in the report that allows the reader to see the input and output data and resulting net energy and EROI values for all the relevant energy sources.

There is a table that provides a comparison for fossil (thermal) fuels shown below as Table 2 (Murphy’s Table 2) but it does not show the energy data. Instead these “investments” are listed as a percentage of total for each technology. Among other things, that makes it impossible to validate the EROI calculations. There is no similar table for renewable energy sources.

I have highlighted the percentage values for oil to show the source of what I believe to be the problem.

Nearly 9% of the total post-extraction costs for oil are for refining. Yet most of the energy for refining comes from the crude oil and refined products used in the refinery. It is, in effect, co-generated. That doesn’t negate the energy investment needed to operate the refinery but it is not a cost to society as indicated in the table.

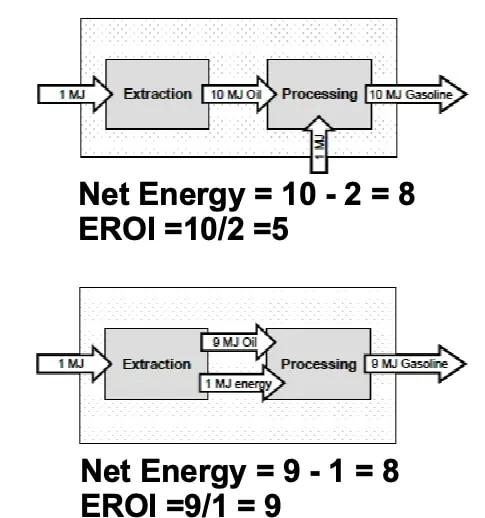

Figure 3 shows how this accounting error affects the EROI calculation. It is modified from Hagens (2010) Figure 5.

The first part of the figure shows 10 megajoules (MJ) of energy coming into the refinery (“Processing) and 1 MJ being added from society. The resulting net energy to produce 10 MJ of gasoline is 8 and the EROI is 5.

In the second part of Figure 3, the identical situation is presented except the 1 MJ of refining investment is “co-generated” from the 10 MJ coming from “Extraction” and not charged to society. The net energy is 8 MJ, the same as in the first case, but the EROI is 9!

That erases much of the good renewable news reported by Ahmed and Bardi.

In Table 3, I have used Murphy et al’s oil transmission and distribution investments (their Table 2) converted from percent to energy units following the format of their Table 1. I divided their 8.9% for refining investment by 3 to account for the co-generation described above (it is probably much lower). The resulting oil EROI is 18. That completely removes the good news from Ahmed’s and Bardi’s proclamations of “mission accomplished” and restores oil EROI to the consensus range for the last two decades.

I am troubled by lack of transparency in the Murphy et al paper particularly their failure to show input and output energy data. I suppose it may be found among the 73 references but that is well beyond the ordinary standards of transparent communication. I located a link for supplementary data that only applied to fossil fuels. Unfortunately, critical inputs for this data were from the ecoinvent database which is unavailable without a paid subscription.

I confess that I do not have much confidence that Murphy et al have accounted for the energy cost for resource extraction or renewable unit production because those investments are not shown in their Table 1 or Table 2.

Another source of confusion is Murphy et al’s use of a life-cycle efficiency factor. This multiplies the energy output of renewable sources by a factor of 3.3 to adjust for their longer-term energy payout.

The efficiency factor for fossil fuels is close to 1 so it does not provide any boost. I am not qualified to dispute the use of this life-cycle term except to say that without it, wind and solar would have EROI values much lower than those for fossil energy.

Nor do Murphy et al discuss the transmission and distribution cost of electricity from renewable energy. You have only to compare your next electricity bill rate to the spot price for your region. In the United States, the retail price is 30 to 50% higher. That makes any percentage in Table 2 above (Murphy et al’s Table 2) seem trivial—including the 8.9% refining penalty that doomed oil to an EROI of 4.2! In fact, De Santis et al (2017) note that

“The cost of electrical transmission per delivered MWh can be up to eight times higher than for hydrogen, about eleven times higher than for natural gas, and twenty to fifty times higher than for liquid fuels.

Murphy et al do not address the effect of intermittency on the net energy supply that society needs to function. They tell us that technology will find a way and perhaps it will but that does not change the present upon which their study is based.

Is Renewable EROI Higher Than Fossil Fuels?

There is a long history of energy research that has consistently come to the same conclusion—fossil fuels are hard to beat.

We now know that their use has consequences for the environment that must be addressed. That doesn’t change the physics that explain why humans have long preferred fossil fuels over energy sources like wind and solar, and continue to even today.

The trend toward using science in the service of a cause is dangerous. This latest effort to re-write the history of net energy and EROI troubles me.

We should all ask ourselves the question, “how can I be wrong?” In that sense, I reluctantly welcome the gambit that Murphy et al, Ahmed and Bardi have opened.

At the same time, when something seems too good to be true, it usually is.

I have shown the uncertainties and problematic nuances that can lead to the misuse of EROI. It is a blunt instrument at best. It offers a quick, high-level way to compare different types of energy but little more. Net energy is a far more useful and straight-forward approach.

I favor a future society that is based largely on renewable energy. That society will look very different that what we know today. Substituting renewables for fossil fuels is not a solution without greatly curtailing our total energy consumption. That’s what the physics indicates will happen in a renewable future. I suggest that we stop trying to make renewables look like something that are not and cannot be, and just learn to live with them as they are.

Like Art's Work?

Share this Post:

Read More Posts

Agreed

https://www.daretothink.org/dfr-the-dual-fluid-reactor/

An EROEI value in the thousands is a game changer.

[…] Art Berman, “Does renewable energy have a higher EROI than fossil fuels?”, 27 de mayo de 2023; https://www.artberman.com/2023/05/27/does-renewable-energy-have-a-higher-eroi-than-fossil-fuels/ . Ugo Bardi, “Is the Energy Return of renewables really higher than that of fossil fuels? A […]

The issue of refining is key here. My understanding is that most of the energy for refining comes froms the refinery itself, mainly low value hydrocarbon streams. This essentially reduces the marketed product. From an EROI perspective, I would subtract this from the numerator rather than adding it to the denominator. On the other hand, purchased natural gas should be added to the denominator. As you note, the results are starkly different depending on methodology.

[…] colleague Ugo Bardi wrote a rebuttal to my recent post in which I explained why the EROI of renewable energy remains lower than that for fossil […]

[…] DOES RENEWABLE ENERGY HAVE A HIGHER EROI THAN FOSSIL FUELS? […]

Hello! Thanks for this sobering comment to the Bardi-Ahmed/Michaux debate. I have also commented upon it two times on my blog, here (a link to the other article is also in there): https://skogslars.blogg.se/2023/may/art-berman-answers-ugo-bardi-and-nafeez-ahmed-2.html

Yours sincerely, Lars Larsen, ecotheologian from Sweden.